Perc Pineda, PhD

Chief Economist, PLASTICS

On February 1, 2025, the U.S. government imposed a 25% tariff on imports from Canada and Mexico and a 10% tariff on imports from China, citing a national emergency under the International Emergency Economic Powers Act (IEEPA) to address threats related to illegal immigration and drug trafficking, including fentanyl.*

Canada quickly retaliated, announcing a 25% tariff on select U.S. products effective February 4, 2025. Mexico also declared it would implement tariff and non-tariff measures against the U.S., but it did not specify which products would be affected. As of February 3, 2025, the U.S., Mexico, and Canada agreed to delay the tariffs by one month. However, on March 3, 2025, President Trump publicly confirmed that the tariffs would take effect on March 4, 2025.

Mexico, Canada, and China are the largest export markets for the U.S. plastics industry. While the U.S. has a plastics trade surplus with Mexico, it runs deficits with Canada and China. Since 2025 trade data is unknown, analyzing 2023 and 2024 trade flows provides a benchmark for assessing the potential impact of these tariffs.

Canada

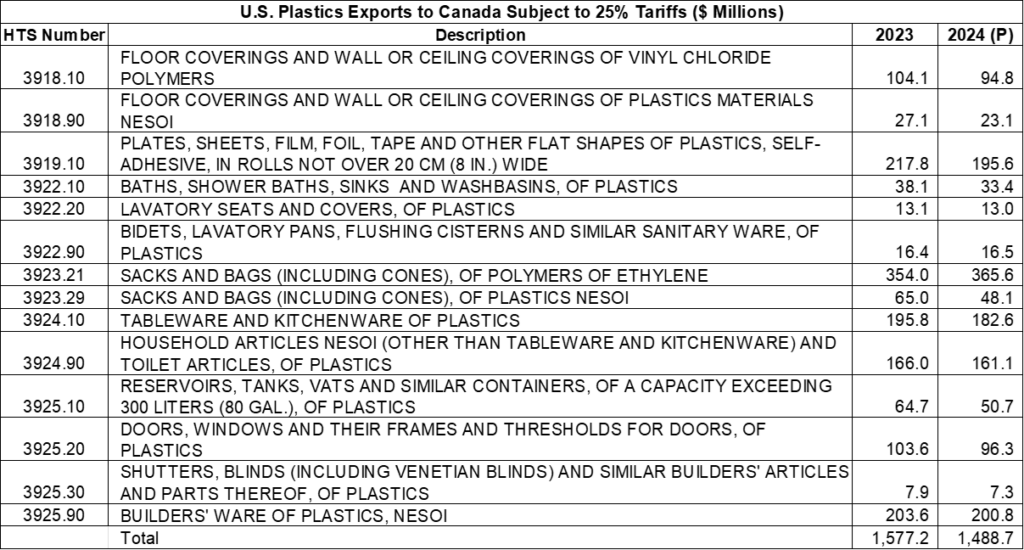

In the list released by Canada’s Ministry of Finance on February 4, 2025, 14 plastic products will be subject to 25% tariffs.** As shown in the table below, U.S. plastics exports to Canada affected by these tariffs amounted to $1.6 billion in 2023 and $1.5 billion in 2024.

Whether Canada will expand the list of tariffed products remains uncertain. However, using preliminary 2024 trade data, if tariffs were imposed on all U.S. plastics exports to Canada, approximately $7.3 billion in resin, products, machinery, and molds would be affected.

On the import side, U.S. tariffs on Canadian plastics industry exports would cover $14.9 billion worth of resin, products, machinery, and molds. Notably, the U.S. had a plastics industry trade deficit with Canada of $731.4 million in 2023 and $963.3 million in 2024.

Mexico

Since Mexico has not specified which products will be subject to tariffs and non-tariff measures, preliminary 2024 trade data suggest that up to $19.8 billion inU.S. plastics industry exports to Mexico could be affected. On the import side, U.S. tariffs will apply to$7.6 billion worth ofplastics industry imports from Mexico at a25% rate. Unlike with Canada, the U.S. had a plastics industry trade surplus with Mexico of $11.6 billion in 2023 and $12.2 billion in 2024.

China

Last year, the U.S. trade deficit in plastics with China was $10.9 billion, slightly lower than the $11.4 billion deficit in 2023. On March 3, 2025, the U.S. government announced an additional 10% tariff onimports from China, bringing the cumulative tariff to 20%, effective March 4, 2025. Based on preliminary 2024 trade data, this could apply to $18.2 billion worth ofplastics industry imports from China. While media reports have focused on China’s retaliation targeting U.S. agricultural exports, U.S. plastics exports to China totaled $7.3 billion in both 2023 and 2024.

Tariff Implications on the U.S. Plastics Industry

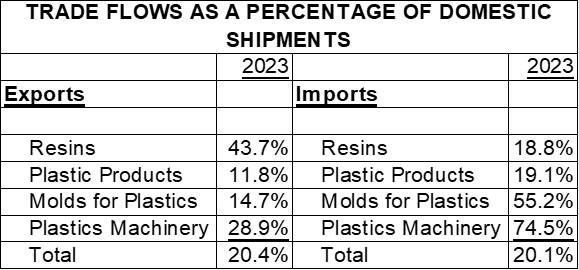

Understanding the share of trade as a percentage of domestic shipments provides context for the impact of tariffs. According to PLASTICS’ 2024 Global Trends Report, plastics industry exports accounted for 20.4% of domestic shipments in 2023.*** Any retaliation from Mexico, Canada, and China would affect a subset of this share. Meanwhile, imports accounted for 20.1% of domestic shipments in 2023.

The impact of higher tariffs on the U.S. plastics industry varies depending on trade shares relative to domestic shipments, as shown in the table above. The direct effects of higher tariffs will be uneven across the industry. Indirect effects include higher manufacturing costs, particularly affecting key plastics end markets such as automotive, medical, industrial, electrical, electronics, and telecommunications. However, the plastics content in these sectors varies, so applying a 25% tariff to a 25% price increase in finished goods would be an oversimplification. Annually, PLASTICS estimates the plastic products content of final demand by industry.**** For instance, the plastics content in automobiles was 4.5%.

Domestic Plastics Manufacturing Update

The latest estimates show that capacity utilization in plastics and rubber products manufacturing declined to 70.4% in January, marking a second consecutive monthly decrease after a brief uptick in November. Capacity utilization has been declining since its peak of 84.5% in January 2021.

2024 has not started strong for plastics manufacturing. The Industrial Production Index for plastic products manufacturing dropped 1.7% in January from December, marking a 2.7% year-over-year decline.

While economic theory suggests higher tariffs are inflationary, time horizon also matters. Moreover, the effect on prices differs whether imports are final goods for consumption or intermediate goods for manufacturing. Given the existing slack in U.S. plastics manufacturing, higher tariffs are unlikely to be immediately inflationary—especially considering import shares relative to domestic shipments and high plastics finished goods inventories. Other factors, such as currency adjustment, substitutes, and demand elasticity, also influence the inflationary effect of higher tariffs.

Global Trade and Policy Considerations

If tariffs remain in place indefinitely, trade volume in plastics between the U.S. and its top three export markets is likely to be lower this year than next. The U.S. plastics industry thrives in a free and fair global trade environment, ranking second in the Global Plastics Ranking® with over $158 billion in trade volume. Higher tariffs will lead to both trade diversion and trade creation, as seen during President Trump’s first term when tariffs on China reshaped trade flows. While U.S. imports of plastics and plastic products from China declined in 2018–2019, they rebounded before the COVID-19 pandemic disrupted global trade.

Given U.S. manufacturing’s reliance on imported inputs and components, policymakers should consider tariff carve-outs for production inputs and equipment that are no longer manufactured domestically. This approach aligns with the Trump administration’s goal of revitalizing manufacturing, minimizing short-term disruptions while working toward the long-term objective of strengthening U.S. industry.

As of March 5, 2025, President Trump has announced a one-month exemption for the tariffs that took effect on March 4. U.S. trade policy continues to evolve, requiring businesses to assess a broader range of scenarios, considering both short-term adjustments and long-term strategic implications.

*The International Emergency Economic Powers Act (IEEPA) is a U.S. federal law enacted in 1977 that grants the President broad authority to regulate commerce in response to a national emergency that originates outside the United States.

**The Canadian Customs 8-digit tariff lines were matched to the 6-digit U.S. HTS numbers.

***For additional information, see PLASTICS 2024 Global Trends Report. www.plasticsindustry.org.

****For additional information and other plastics content by industry, see PLASTICS 2024 Size and Impact Report. www.plasticsindustry.org.