Perc Pineda, PhD

Chief Economist, PLASTICS

The plastics industry experienced a mix of challenges and shifts in 2024, beginning with early gains but encountering a slowdown in production and shipments as the year progressed. Fluctuations in resin prices and reduced capacity utilization in plastics production further influenced industry performance, which was shaped by evolving economic conditions. The sector also faced continued pressures from a sluggish domestic and global manufacturing environment, with the manufacturing labor force remaining a persistent supply-side challenge. These dynamics, which impacted plastics manufacturing trends, employment, and trade, are analyzed below using recently available data.

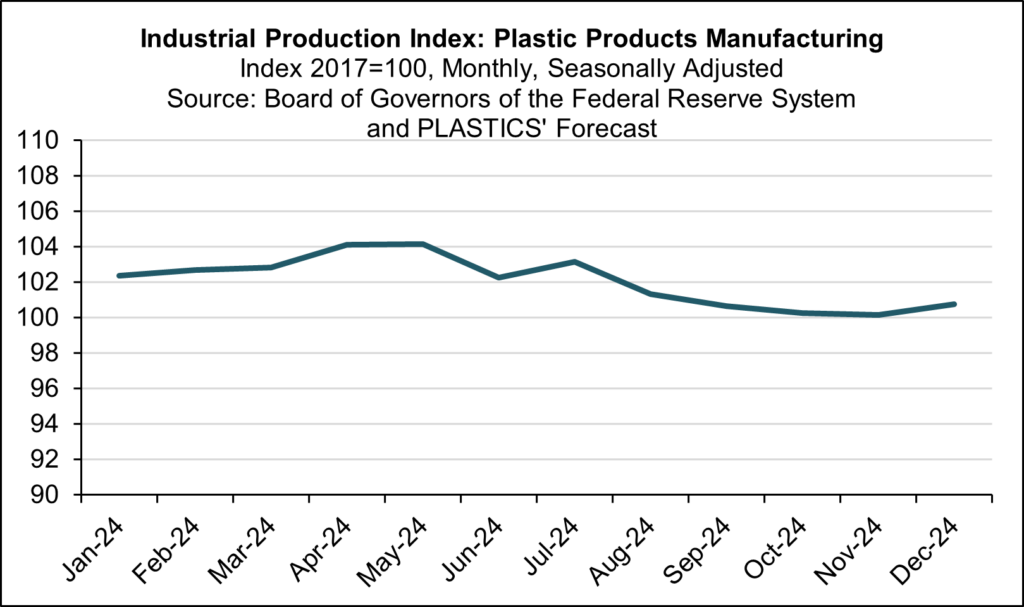

Plastic Products Manufacturing

Plastic products manufacturing in 2024 can be characterized by gains in the first half of the year, which were pared back in the second half. Month-over-month growth peaked in April at 1.2%. However, production declined year-over-year for the past eight consecutive months. While a marginal increase is projected for December, full-year production may be lower by an estimated 1.7% compared to 2023. Although plastic production remained above the 2017 benchmark, growth would likely have been higher if not for the higher borrowing costs that hindered the expansion of plastics end markets.

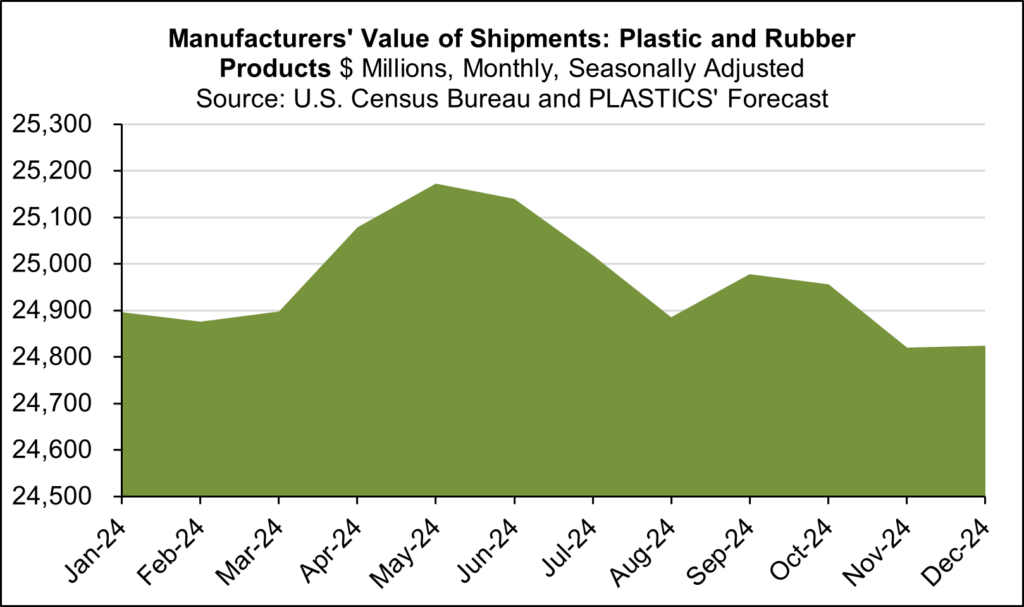

Plastics and Rubber Shipments

Shipments of plastic and rubber products showed minor fluctuations, with intermittent growth peaking at 0.7% in May, reaching $21.5 billion. However, the overall trend was marked by frequent minor declines, including a 0.5% drop in August. After a slight uptick in September, shipments declined through November and are expected to have flattened in December at $24.8 billion. While the U.S. experienced another year of economic growth in 2024, personal consumption expenditures on both durable and nondurable goods grew at slower rates than in 2023, slowing shipments. For comparison, monthly shipments averaged a 0.1% increase in 2023 but averaged a 0.1% decrease in 2024.

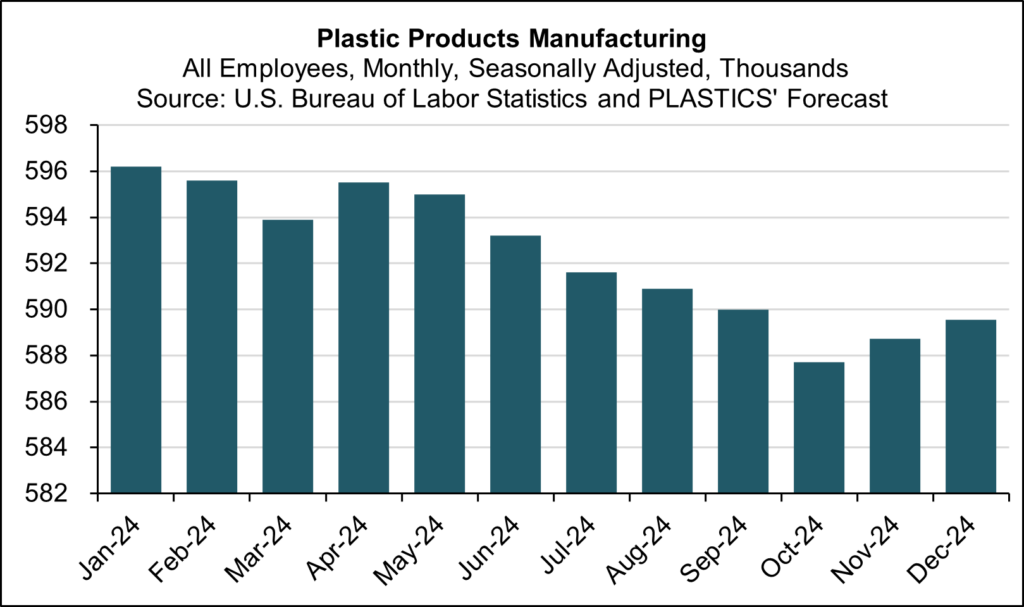

Plastics Manufacturing Employment

As in the overall U.S. manufacturing sector, companies are expected to increase output to meet market demand despite a shrinking labor force. The decline in labor share in production has led to greater reliance on capital investment in technology, which in 2024 was hindered by the higher capital cost. The plastics industry was no exception. Data from the Bureau of Labor Statistics indicates a downward trend in plastic products manufacturing. Employment likely rose slightly by 0.2% in November and 0.1% in December. However, employment is estimated to have declined by 0.9% year-over-year in December 2024, totaling approximately 589,542.

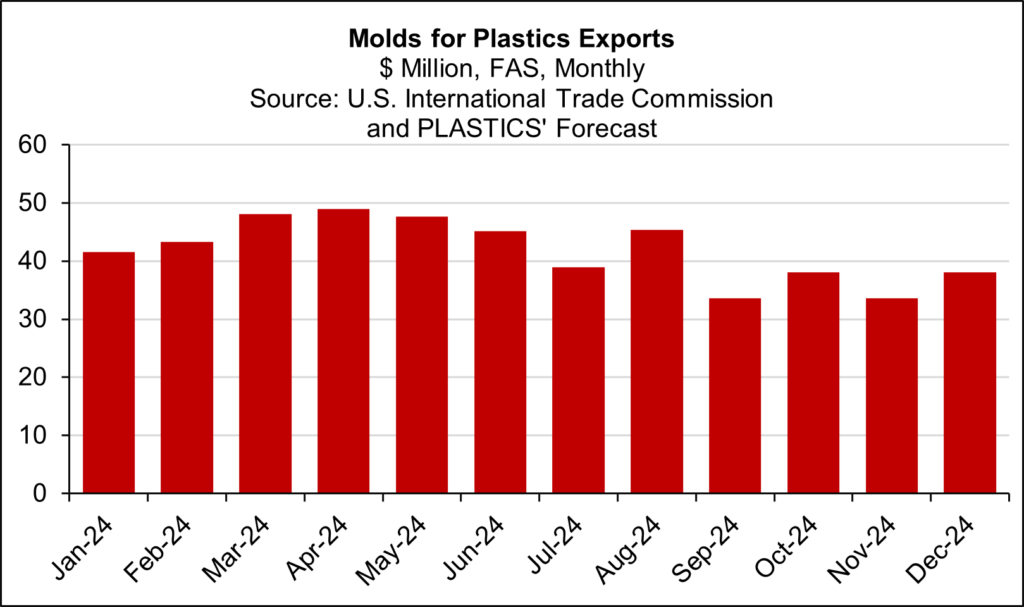

Molds for Plastics Export

Lingering weakness in the manufacturing sector—the primary customer of the plastics industry—is reflected in the 2024 molds export data. Global manufacturing grew by just 0.1% in the first nine months of 2024, according to the United Nations Industrial Development Organization, corresponding with a decline in the dollar value of molds exports. After increasing steadily from January to April, exports fluctuated, reaching a peak growth of 17.0% in August before declining by 25.8% in September. October saw a 13.0% increase, but with a balanced outlook for November and December, molds trade in 2024 is expected to be 8.7% lower than in 2023. The projected decrease to $502.4 million is primarily due to shifts in the composition of molds exports, which led to lower export values.

The quantity of molds exported increased by 51.8% year-to-date through October compared to the same period in 2023, driven by a 126.4% rise in exports of injection/compression molds for semiconductor devices (HTS 8480.71.4000). Of these, 73.5% were exported to Mexico, accounting for 33.1% of the total export value. Other categories experienced declines in both value and quantity, a trend that likely persisted through the final months of 2024.

Producer Prices in Plastic Materials and Resin Manufacturing

Resin prices remained stable throughout 2024, with monthly averages fluctuating by only 0.2%, aside from a brief dip in September. The 3.1% decrease in the resin price index in September can be attributed to several factors noted by industry observers: an increase in polypropylene supply amid weaker demand led to a decline in PP prices, PET bottle resin prices fell due to subdued demand, and weaker export demand further pressured overall resin prices. Additionally, an estimated 1.3% decrease in demand for mineral water, soft drinks, and vegetable juices in 2024 affected PET demand, keeping prices low. This stability includes a likely 1.0% uptick in the resin price index in December, which offset a 1.0% decline in November.

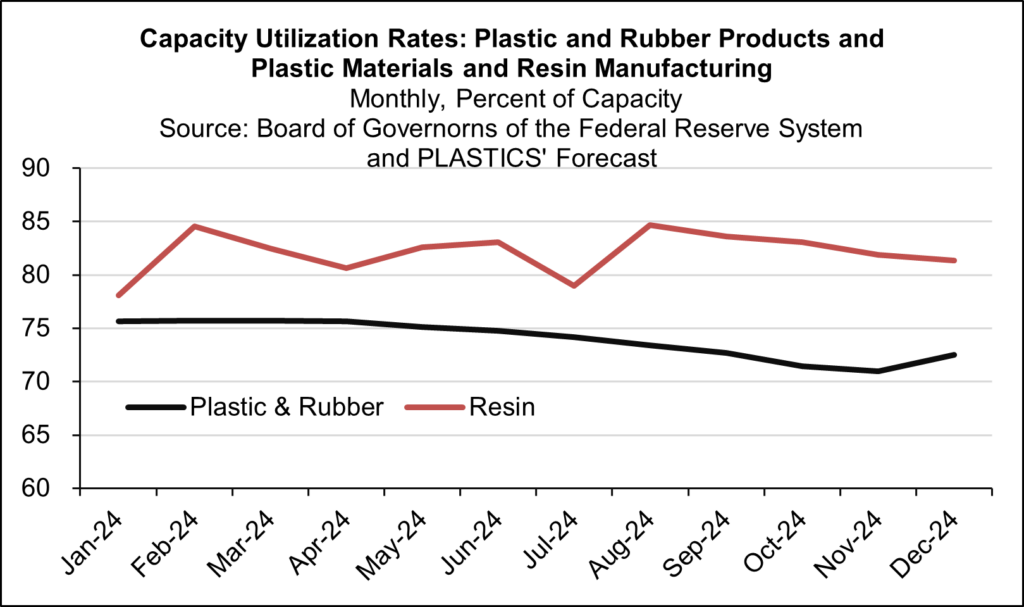

Capacity Utilization Rates in Plastic and Resin Manufacturing

Capacity utilization in resin manufacturing was generally stable with slight fluctuations, while plastics and rubber products manufacturing experienced a flat-to-declining trend. Over the past twelve months, resin capacity utilization remained mostly above 80.0%, except for January and July. November and December likely recorded capacity utilization rates of 82.0% and 81.0%, respectively. The 5.7% increase in capacity utilization from July to August aligns with the rise in resin supply, which exerted downward pressure on prices the following month.

Capacity utilization in plastic and rubber products manufacturing continued its downward trend. After remaining at 76.0% for four months and then declining to 75.0% for two months, it further decreased to 71.0% in October and November. A modest rebound to 73.0% is expected in December.

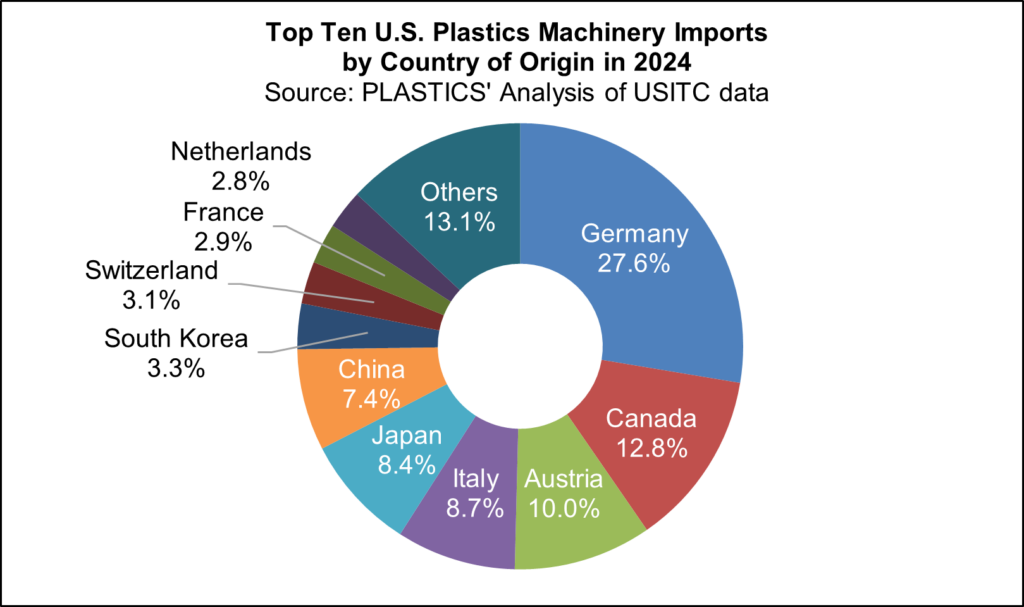

Plastics Machinery Imports

As of October, U.S. plastics machinery imports year-to-date were estimated at $2.9 billion. The top five countries of origin—Germany, Canada, Austria, Italy, and Japan—accounted for 67.4% of total imports in 2024. With two months of trade data yet to be released by the U.S. Census Bureau, the concentration of imports from these five countries is unlikely to change for the full year. Including China, South Korea, Switzerland, France, and the Netherlands, the top ten countries supplied 86.9% of U.S. plastics machinery demand, with the remaining 13.1% sourced from other countries. U.S. imports of plastics machinery are expected to decline by an estimated 2.0% to $3.4 billion in 2024.

The plastics industry’s outlook will continue to be shaped by macroeconomic fundamentals and will evolve alongside changing policies, such as those on taxes, trade, and broader fiscal and monetary policies. The manufacturing labor force will remain a supply-side challenge, while lower interest rates are expected to reduce risk aversion, supporting capital expenditures and creating new opportunities for project development and product line expansion, ultimately boosting industry capacity utilization. Despite a stable demand outlook for plastics, initial conditions matter. Given slow-clearing inventories, the industry could realistically experience incremental increases or marginal declines in production in 2025 as it emerges from the manufacturing slump of the past two years.