Perc Pineda, PhD

Chief Economist, PLASTICS

Business inventories in the U.S. economy have remained above $2.51 trillion since August 2022, according to data from the U.S. Census Bureau. In November of last year—the most recent data available—business inventories totaled $2.59 trillion, reflecting a 0.1% increase from October and a 2.6% rise compared to the previous year.*

Inventories are cyclical and align closely with the business cycle. They tend to increase during periods of economic growth and contract during downturns. Recessions, typically characterized by rising unemployment, lead to reduced personal income in the household sector, which curtails spending. This, in turn, prompts businesses to clear out inventories and cut production.

During the 2008–09 Great Recession, total business inventories in the U.S. experienced their largest month-to-month decline in December 2008, dropping by $32.2 billion. Similarly, during the COVID-19 pandemic, the sharpest decrease occurred in May 2020, when inventories fell by $47.3 billion.

In the plastics and rubber products manufacturing sector, inventories declined by $923 million in December 2008. During the pandemic, the largest drop was $317 million in June 2020.

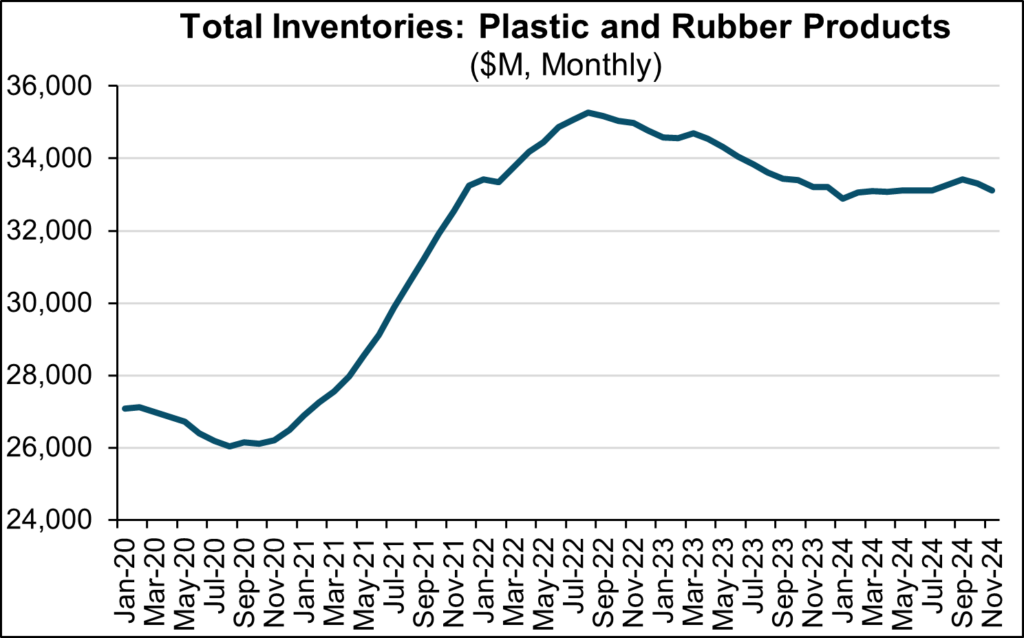

Inventories typically increase as the economy recovers from a recession, driven by a rebound in household spending and a rebalancing of business production. However, an excessive inventory buildup following an economic contraction can take time to reduce. As shown in the chart below, inventories of plastic and rubber products rose from $20 billion in 2020 to $35.3 billion in August 2022. Since February 2022, they have gradually decreased but have remained above $33.0 billion.

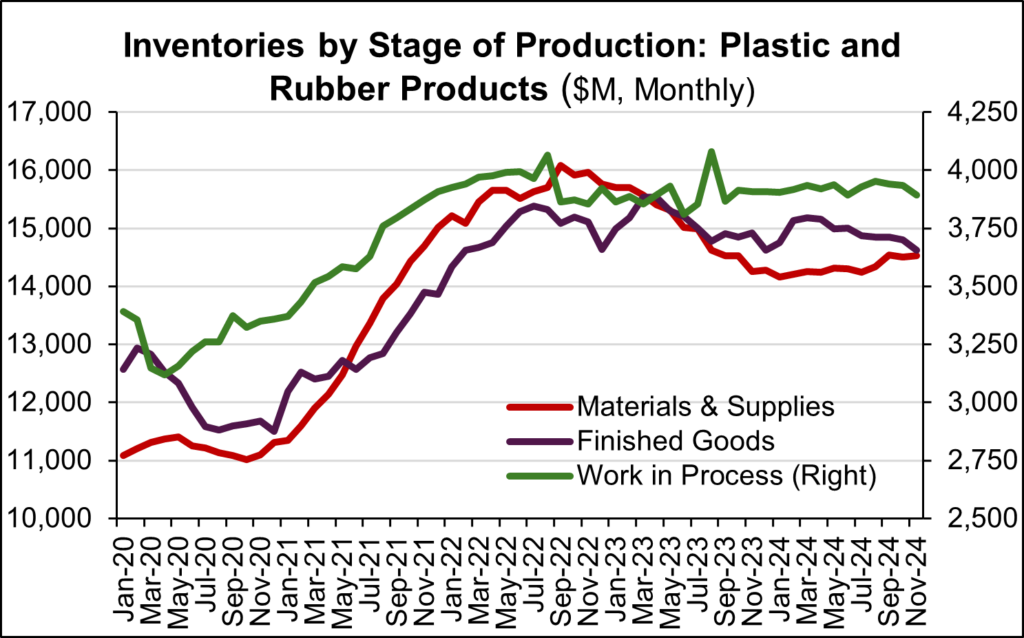

A closer look at the breakdown of plastic and rubber products inventories highlights how manufacturing has maintained steady production. Work-in-process inventories averaged $3.9 billion in 2023 and 2024, with occasional spikes in certain months. Finished goods inventories decreased slightly from $15.0 billion in 2023 to $14.9 billion in 2024. Materials and supplies inventories declined from an average of $14.9 billion in 2023 to $14.3 billion in 2024, despite a significant increase from $11.0 billion in November 2020.

The trends in U.S. business inventories reflect the interplay between economic cycles and the corresponding production adjustments of the business sector. Overall, the data suggests there is currently no shortage of materials and supplies in the plastics and rubber products manufacturing sector.

*This article utilizes data from the U.S. Census Bureau.