Perc Pineda, PhD

Chief Economist, PLASTICS

In December, the U.S. economy added 256,000 nonfarm payroll jobs, according to the Bureau of Labor Statistics (BLS). Of these, 87.1% were in the private sector, while 12.7% were in government. Within the private sector, the goods-producing industries experienced mixed results: nondurable goods manufacturing added 3,000 jobs, but this was offset by a loss of 16,000 jobs in durable goods manufacturing, leading to a net decline of 13,000 jobs in manufacturing. Overall, the goods-producing sector lost 8,000 jobs in December, while the services sector drove private-sector growth with a gain of 231,000 jobs. For the year, monthly job losses in manufacturing were offset by job gains, resulting in a net annual loss of 87,000 jobs.

The U.S. economy’s unemployment rate was 4.1% in December, while the manufacturing unemployment rate was 3.5%, consistently remaining below the overall unemployment rate throughout 2024. The manufacturing unemployment rate averaged 3.2% for the full year, fluctuating between 2.7% and 3.6%.

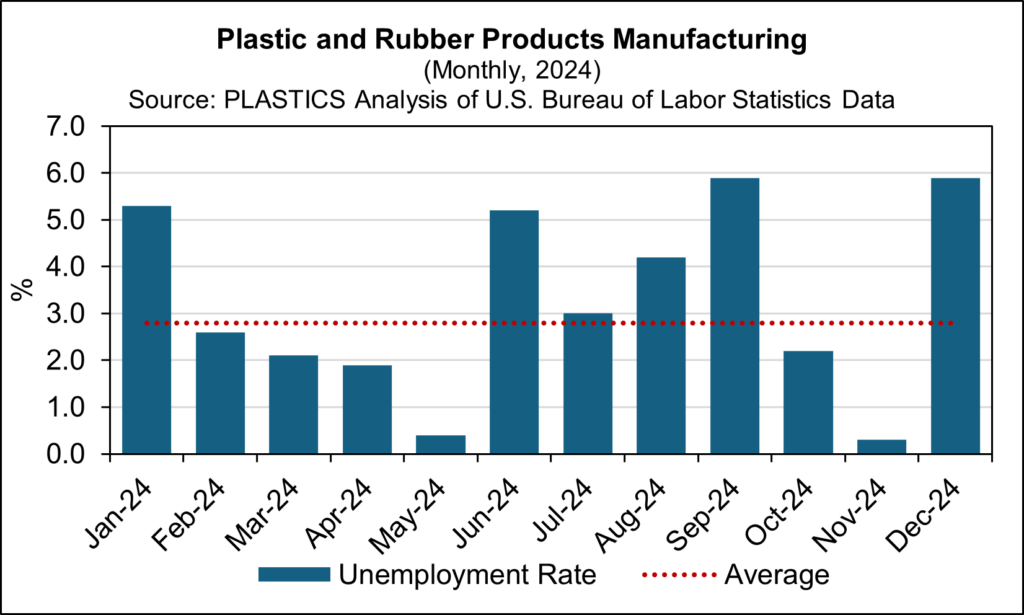

In the plastics and rubber products manufacturing sector, the unemployment rate rose to 5.9% in December. The monthly unemployment in this sector ranged from 0.3% to 5.9% in 2024, as illustrated in the chart below. Although the average monthly unemployment rate was 2.8%, the industry continues to struggle with filling vacant positions.

With the manufacturing workforce expected to remain a supply-side challenge in the foreseeable future, it is likely that many vacancies in the sector will go unfilled. According to the latest data from BLS, there were an estimated 412,000 job openings in manufacturing in November, while total hires for the month reached 289,000—leaving 123,000 positions unfilled. It is unlikely that this scenario changed significantly in December.

Meanwhile, the labor component of U.S. manufacturing—including the plastics industry—has been decreasing, even as the sector faces the dual challenges of increasing output and competing globally. As manufacturing processes become more technical, the skills gap between labor supply and demand continues to widen. The demand for manufactured goods is not diminishing, as consumer spending continues to be a balance between goods and services.* While the manufacturing workforce possesses some transferable skills, and labor mobility across manufacturing sectors can offer temporary relief, the demographic realities of the U.S. workforce make this approach unsustainable in the long term. For the U.S. manufacturing sector to thrive in domestic and global markets, it is crucial to address labor supply challenges strategically.

*The Plastics Industry Association provides a monthly estimate of plastic products demand, which can be downloaded from https://www.plasticsindustry.org/resource/plastics-demand-estimate/